30+ How to calculate loan capacity

Use This Powerful FHA Loan Benefit for Your Next Home. Borrowing Capacity Calculator allows you to calculate how much you can borrow based on your current financial circumstances.

Direct Credit Home Loans Tailored Residentail Commercial Loans Direct Credit

200000 450000 900000 5 0006157 0 4000000.

. Its quite simple really. The amount of Income you make each month. Here are 11 ways to increase your borrowing power to buy a better home.

Compare home buying options today. Lenders generally follow a basic formula to calculate your borrowing capacity. This calculator will help you estimate your home loan borrowing capacity the value of the home you can afford assuming you are buying with a 20 deposit and your monthly repayment.

On a 30-year jumbo mortgage the. Receive Your Rates Fees And Monthly Payments. North Carolina land financing with flexible payments to meet your cash flow needs.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Just take your stabilized NOI divide it by your target. Thus as part of calculating your borrowing capacity it is.

The average 30-year fixed-refinance rate is 632 percent up 21 basis points compared with a week ago. Suppose for example that you were comparing. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly.

Fixed or floating interest rate. The Payment Method determines when the first payment is due. A serviceability is often.

Ad Calculate Your Payment with Low Money Down. Examine the interest rates. Return to home mortgage.

21 to 65 years. Were Americas Largest Mortgage Lender. To calculate the loan amount as accurately as possible you will need to enter the monthly repayment you want the duration of the loan and the interest rate of the loan.

To get the final capacity result just round. It takes into consideration your current income assets and. Ad Compare Mortgage Options Calculate Payments.

35 the capacity is 399- 39910359. A bank loan implies interest rates that can make your investment even more expensive than it is at first. Bank normally determine your borrowing capacity.

The borrowing capacity formula. If you know how to cap NOI to arrive at a value you know how to turn debt yield into a loan amount. Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP.

Ad Move quickly on your North Carolina land purchase with a simple online loan application. Gross income - tax - living expenses - existing commitments - new. The calculator calculates the number of monthly payments.

Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider. 21 to 65 years. A month ago the average.

Percent Interest Per Annum. The higher the loan amount the higher the EMI payable. Age Limit for Salaried Individuals.

The maximum loan term is generally capped at 30 years. Get Offers From Top Lenders Now. The mortgage calculator will take this information and display a graph detailing the amount of interest you will pay to each potential lender.

I now additionally reduce the velocity after the weakening by the Safety Buffer. Lock Your Mortgage Rate Today. There are many different ways to calculate the.

To calculate the loan amount as accurately as possible you will need to enter the monthly repayment you want the duration of the loan and the interest rate of the loan. Usually this can be calculated as follows. Compare Quotes Now from Top Lenders.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. The Presidents tax reform proposal will increase the minimum tax on US. Apply Now With Quicken Loans.

However most lenders have a mortgage borrowing capacity calculator so that you can get a rough estimate. Ad Get Your Best Interest Rate for Your Mortgage Loan. With the default selection End-of-Period the first payment will.

Usually 4 but can. Trusted Finance hopes that this article will give you a deeper and broader insights of how lenders ie. A loan is a contract between a borrower and a lender in which the borrower receives an amount of money principal that they are obligated to pay back in the future.

Test your borrowing capacity. Multiple the monthly income by 12 to get a notional yearly income. Age Limit for Self-Employed Individuals.

Buying or investing in. 2 days ago30-year mortgage refinance advances 021. The result of this.

Oportun Provides Business Update Oportun Financial Corp

Bringing It Home Raising Home Ownership By Reforming Mortgage Finance Institute For Global Change

What Is Foir How Do You Calculate It Quora

Tables To Calculate Loan Amortization Schedule Free Business Templates

Deposit Calculator How Much Do I Need To Buy A House Or Home Loan

Nope Auto Loan Delinquencies And Repos Are Not Exploding They Rose From Record Lows And Are Still Historically Low Wolf Street

What Are The Pros And Cons Of Pre Closing A Home Loan Quora

![]()

Plugins Categorized As Loan Calculator Wordpress Org

Predicting Loan Repayment Introduction By Imad Dabbura Towards Data Science

How To Complete Nashp S Hospital Cost Calculator The National Academy For State Health Policy

How To Calculate Interest In A Moratorium Period Quora

Jim Fishinger On Linkedin What Do Mortgage Lenders Look For 1 Creditworthiness Including

![]()

Plugins Categorized As Loan Calculator Wordpress Org

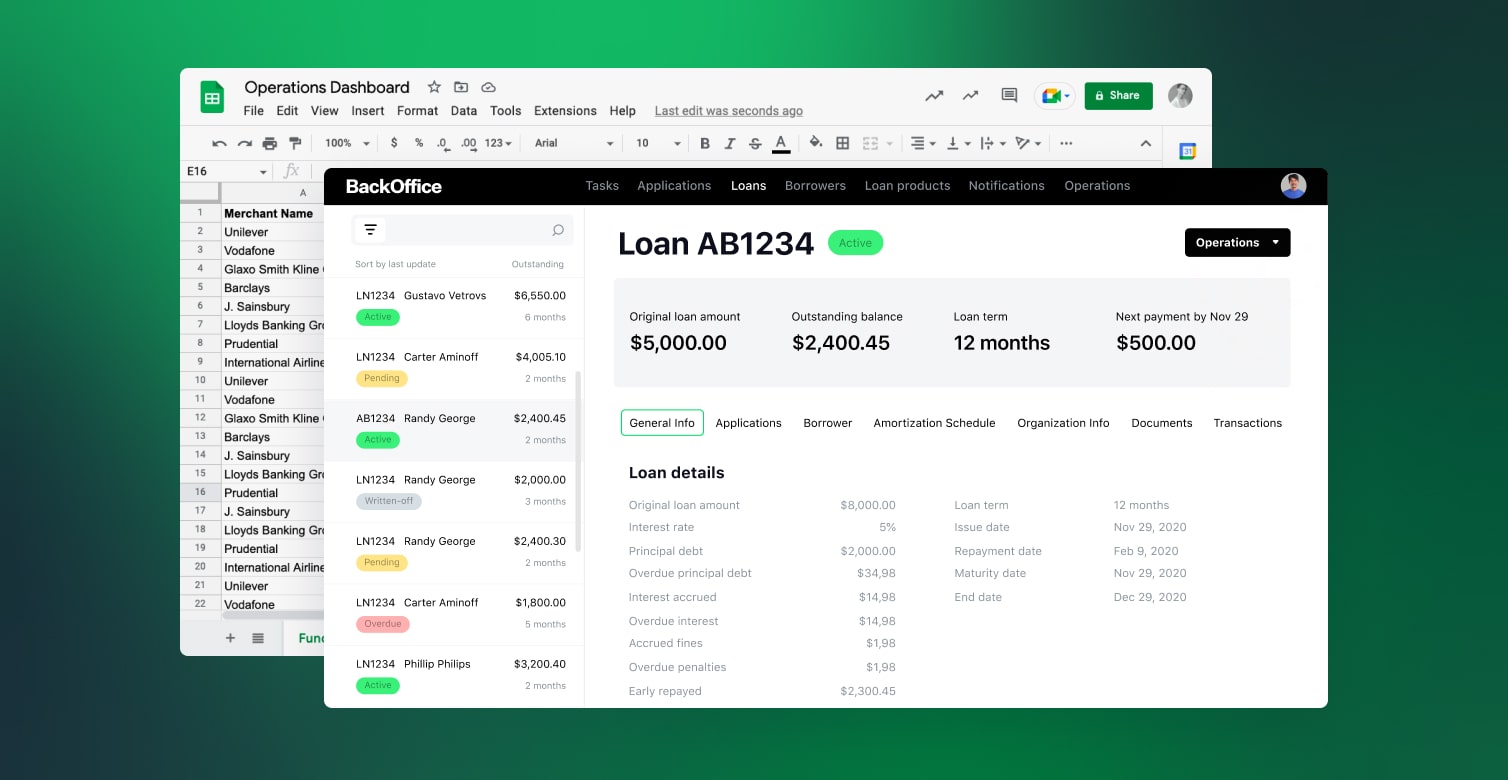

Why Do Lenders Prefer Software To Excel Loans Spreadsheets Hes Fintech

Average Collection Period Formula Calculator Excel Template

How Much Money Will I Get As A Home Loan And What Is The Emi Quora

Lvr Calculator And What Is Loan To Value Ratio Calculate Lvr